DML & MMD

One of the best-known methodologies compatible with DML levels is the MMD methodology. The author of the "MMD Knowledge Pyramid" is Mariusz Maciej Drozdowski. The MMD methodology consists of a range of tools and models based on historical price charts. More information and tools related to the MMD methodology can be found on the MagicOnCharts.com website.

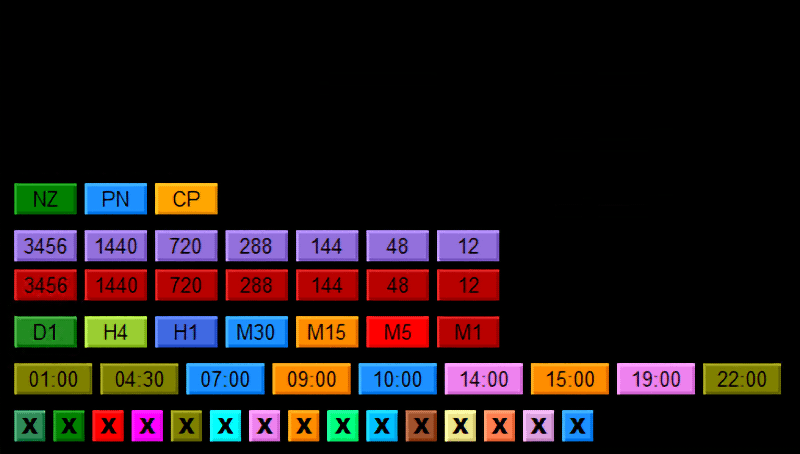

Unified Management Panel

Together with representatives and users of the MMD methodology, we have prepared a unified management panel for tools compatible with the MMD methodology and DML levels.

Free and Paid MMD Tools

Many indicators useful in trading - not only for those using the MMD methodology - available on the MagicOnCharts.com website are completely free.

Building Market Advantage with MMD & DML

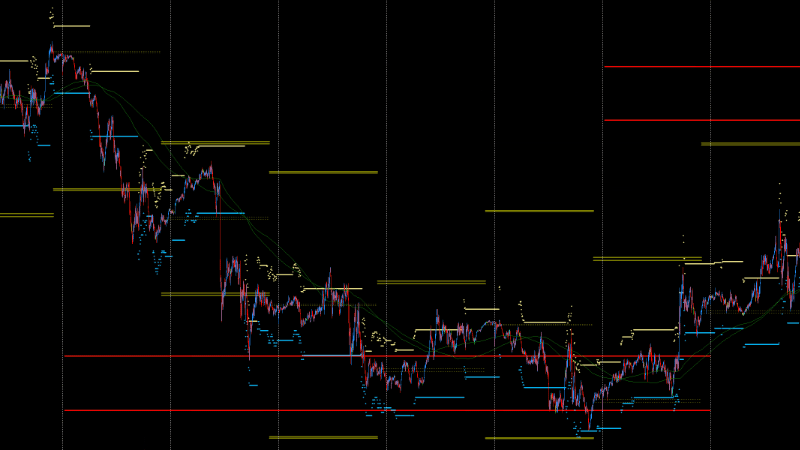

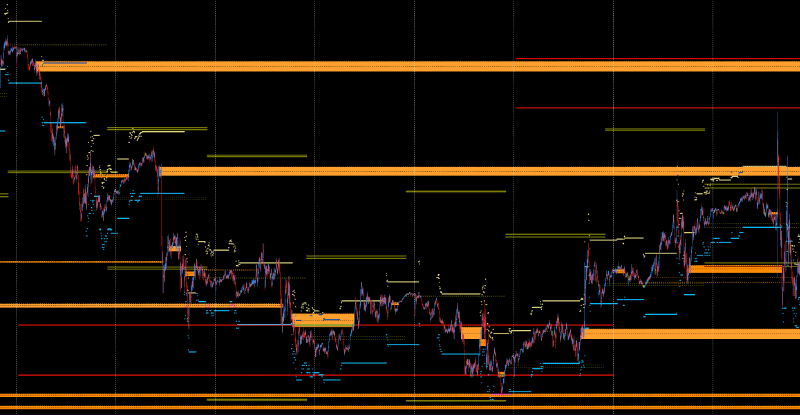

Average Clouds

The foundation of the MMD methodology is the use of moving average clouds. An MMD moving average cloud is the space between the SMA and EMA of the same value. MMD includes a whole set of averages, often with very high values: 12, 48, 144, 288, 720, 1440, 3456.

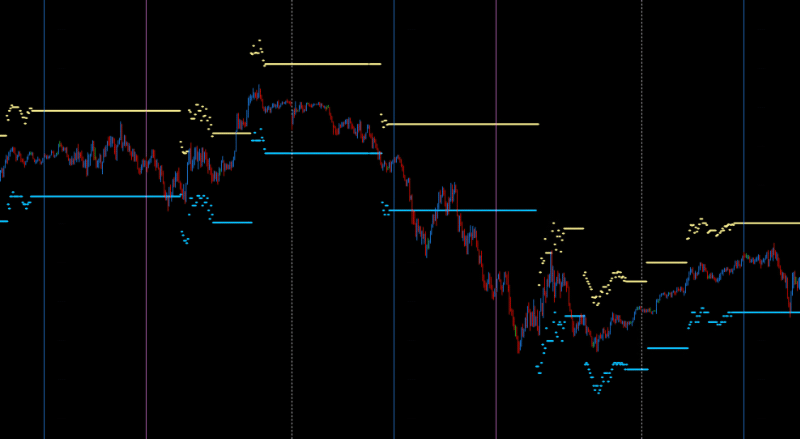

Diamonds in the MMD Methodology

Diamonds are specific candlesticks that occur on every time frame and to which price reacts consistently. If an MMD Diamond appears at a key DML level, it provides a trading signal with a high potential for success. MMD Diamonds often appear in trend-ending movements, which allows for highly successful trading in low-liquidity markets, such as during the Asian session. You can check this yourself on the M5 time frame.

Time Frames

Specific time intervals are a very important element in the MMD methodology. These include individual trading sessions (Asian, European, American) and repeatedly confirmed zones resulting from FZ (Flow Zone) levels. The appearance of FZ zones, supported by the Time Separator indicator (available for free on MagicOnCharts.com), builds a significant advantage in making both short- and long-term investment decisions.