DML & other strategies

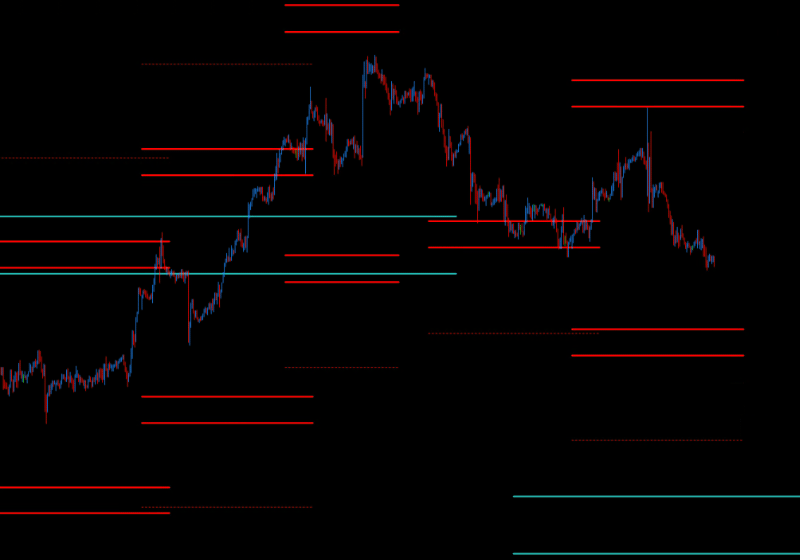

Combining DML levels — which are a unique projection of future price behaviors — with various technical analysis methods allows for a more comprehensive market view, increasing the confidence of investment decisions. Each combination has its advantages across different timeframes and market types, allowing the strategy to be tailored to the trader's individual needs and preferences.

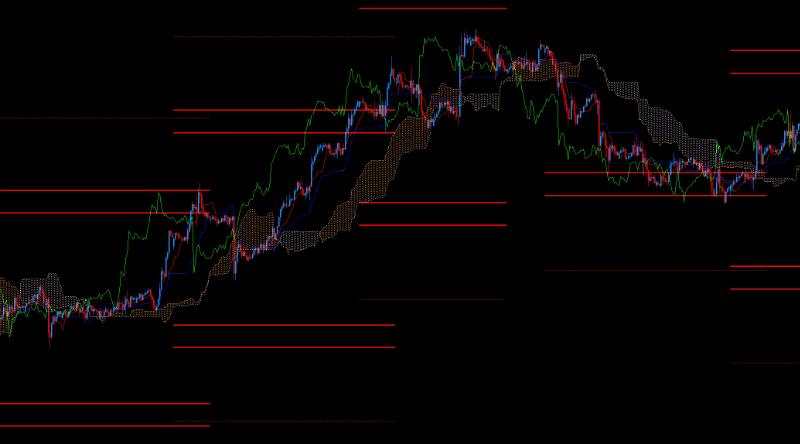

DML levels and Ichimoku Kinko Hyo

Method Description: Ichimoku Kinko Hyo is a technical indicator that provides a complete market view, including support and resistance lines, trend direction, and entry and exit points.

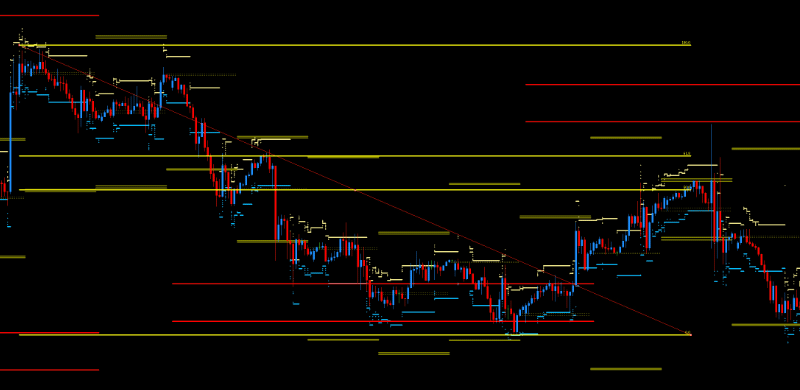

DML levels and Fibonacci Retracements

Method Description: Fibonacci retracements are used to identify potential support and resistance levels in the market. The most popular levels are 50% and 61.8%.

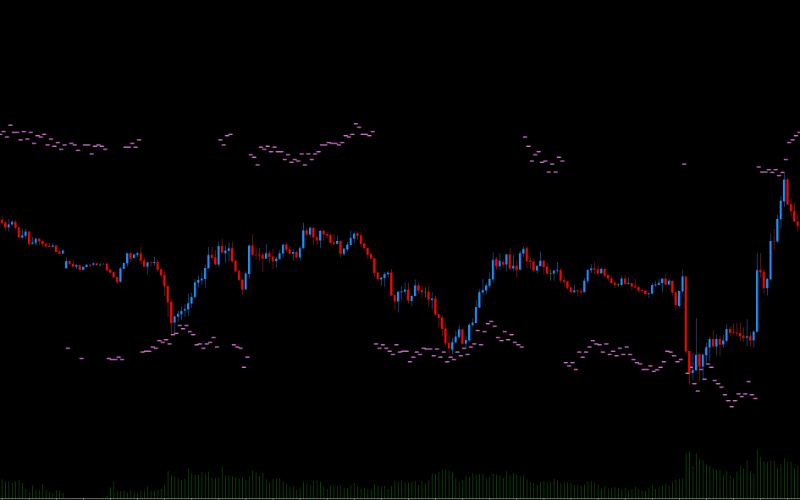

DML levels and Volumes

Method Description: Volume analysis involves monitoring the level of trading activity (volume) to help identify points where demand or supply may suddenly change.

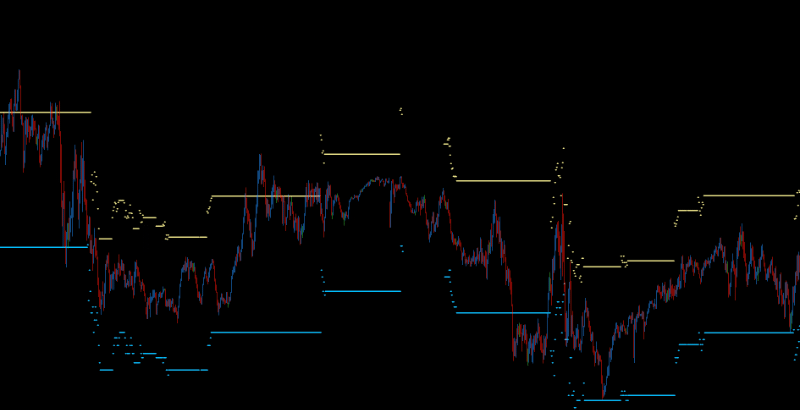

DML levels and Range Trading

Method Description: The range trading strategy involves identifying support and resistance levels between which the price moves.

DML levels and Timeframes

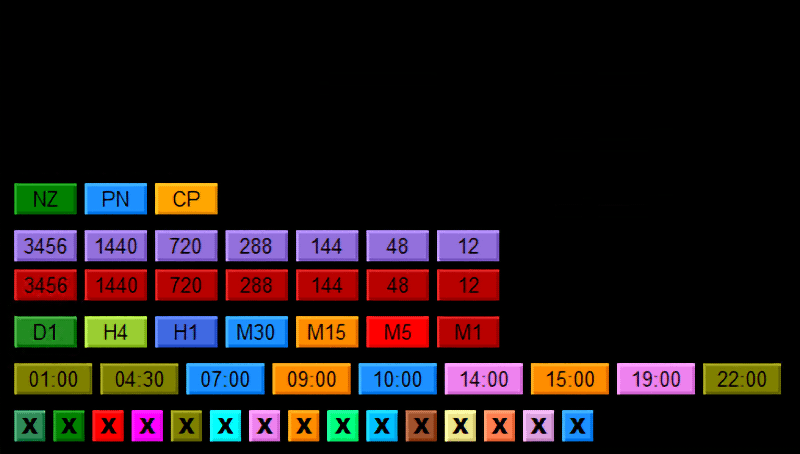

Short-term (intraday): DML levels can be combined with indicators such as Ichimoku, moving averages, or volumes to obtain quick trading signals on smaller timeframes (e.g., M1, M5, M15).

Test a unique combination

See how the MMD methodology works with DML levels. Register for free at MagicOnCharts.com and download free indicators to support your trading, harnessing the potential of the MMD methodology backed by DML levels.