Lesson #17 - JUMP Levels

JUMP levels are a unique group of DML levels, named after the dynamic "jumps" in price, after which a signal appears indicating an opportunity to take a position. These levels are characterized by sharp breakouts of several dozen pips up or down, which often signal a change in sentiment among large market participants, such as liquidity providers.

Particular attention should be paid to these breakouts occurring during normal trading hours. Breakouts during macroeconomic data releases are a common phenomenon, while dynamic jumps during regular trading hours indicate a significant shift in market sentiment.

The JUMP level group is also characterized by the appearance of so-called "clouds" of levels. A cloud consists of several dozen levels (updated every 5 minutes), with each subsequent level appearing a few pips from the previous one. A breakout from such a cloud signals an opportunity to take a position - a breakout upwards signals a SELL opportunity, while a breakout downwards suggests a BUY opportunity.

Within the JUMP group, there are levels that appear not only in the form of clouds but also as lines acting as support or resistance, which are simultaneously "broken" and generate signals in the same way as the classic JUMP levels.

Research and discovery of new JUMP levels for various currency pairs are ongoing, as the repeatability and effectiveness of JUMP signals are above average. Observations show that some JUMP levels appear on the chart at a considerable distance (even several hundred pips) from the current price level. However, breakouts at these levels behave just like breakouts at classic JUMP levels.

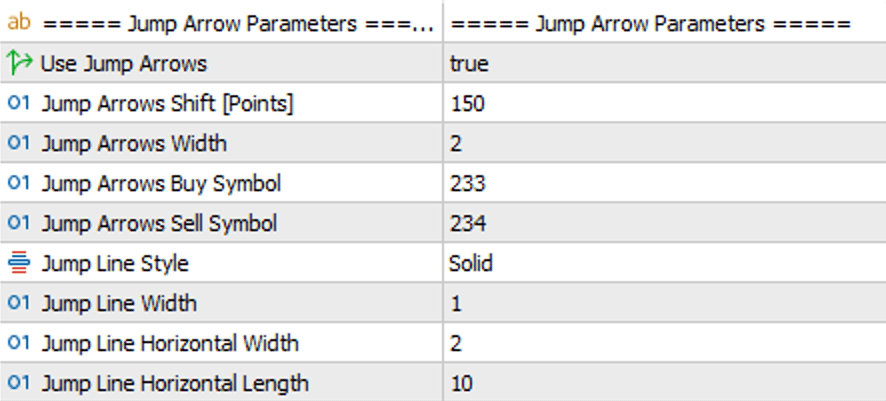

To facilitate the review of historical data (to confirm the effectiveness of JUMP levels) and real-time signaling of breakouts, we have developed an additional feature in the DML MultiButton PRO indicator. We called it "JUMP Arrow," as an arrow appears at the point of the breakout, indicating the suggested trade direction. Visit the TOOLS section on this site, install the indicator on your trading platform, explore this feature's capabilities, and see how helpful and unique this tool is.

Research shows that JUMP levels most frequently appear on currency pairs involving the Japanese yen (JPY), although they also appear on other currency pairs, albeit much less frequently. On different currency pairs, JUMP levels may have different colors.

The optimal strategy is to use several JUMP levels on one currency pair simultaneously. It may happen that one color generates only one signal per day, but using multiple levels provides the opportunity to receive several signals per day, with potential moves of several to dozens of pips.

Combining JUMP signals with levels from the Flow Zone group or other DML levels allows traders to take positions with exceptional precision and a high probability of success.

Want more knowledge?

Flow Zone Levels

Flow Zone (FZ) levels are liquidity flow-based indicators that serve as key support and resistance levels in the currency market. They are calculated using advanced algorithms that analyze high-value transactions and market dynamics. Due to their precision, FZ levels can be used by traders to identify critical moments in the market where price direction changes are likely to occur.