Lesson #1 - EURCAD

Trading the EURCAD pair is characterized by a specific dynamic resulting from the differences in the monetary policies of the European Central Bank (ECB) and the Bank of Canada (BoC). Additionally, the value of this currency pair is influenced by macroeconomic factors such as industrial production data, inflation, employment, and changes in commodity prices, particularly oil, of which Canada is one of the major exporters.

EURCAD Characteristics

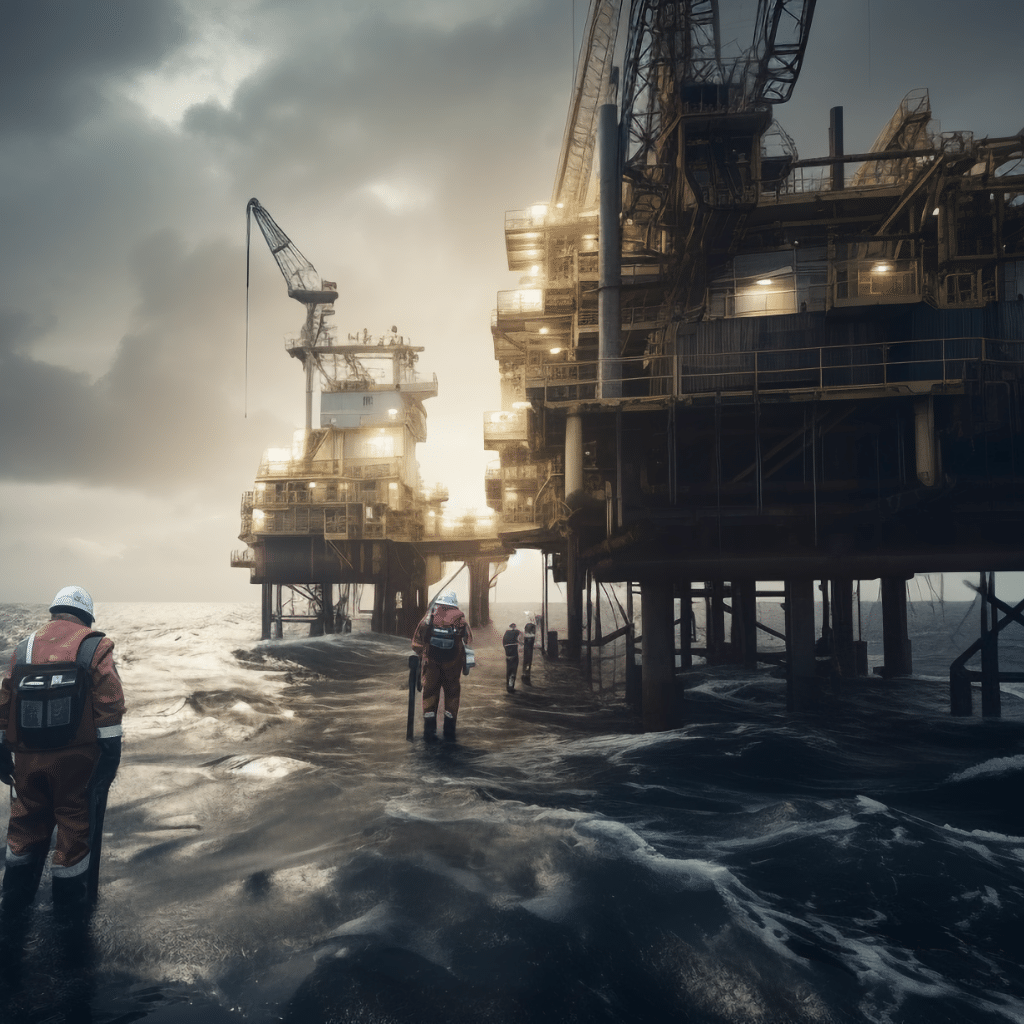

The EURCAD currency pair, consisting of the euro (EUR) and the Canadian dollar (CAD), is an interesting trading instrument in the Forex market. The euro, the official currency of the Eurozone, is used by most of the European Union member states, making it one of the most important currencies in the world. The Canadian dollar, on the other hand, is the currency of Canada, a country with a stable economy rich in natural resources such as oil and natural gas.

This is a cross-currency pair, meaning it does not include the US dollar, which often serves as an intermediary currency in foreign exchange transactions.

The exchange rate of this pair is sensitive to many factors, including the monetary policy decisions of the European Central Bank (ECB) and the Bank of Canada (BoC), as well as changes in the economies of both regions. Commodity prices, especially oil, which is a key export commodity for Canada, also have a significant impact.

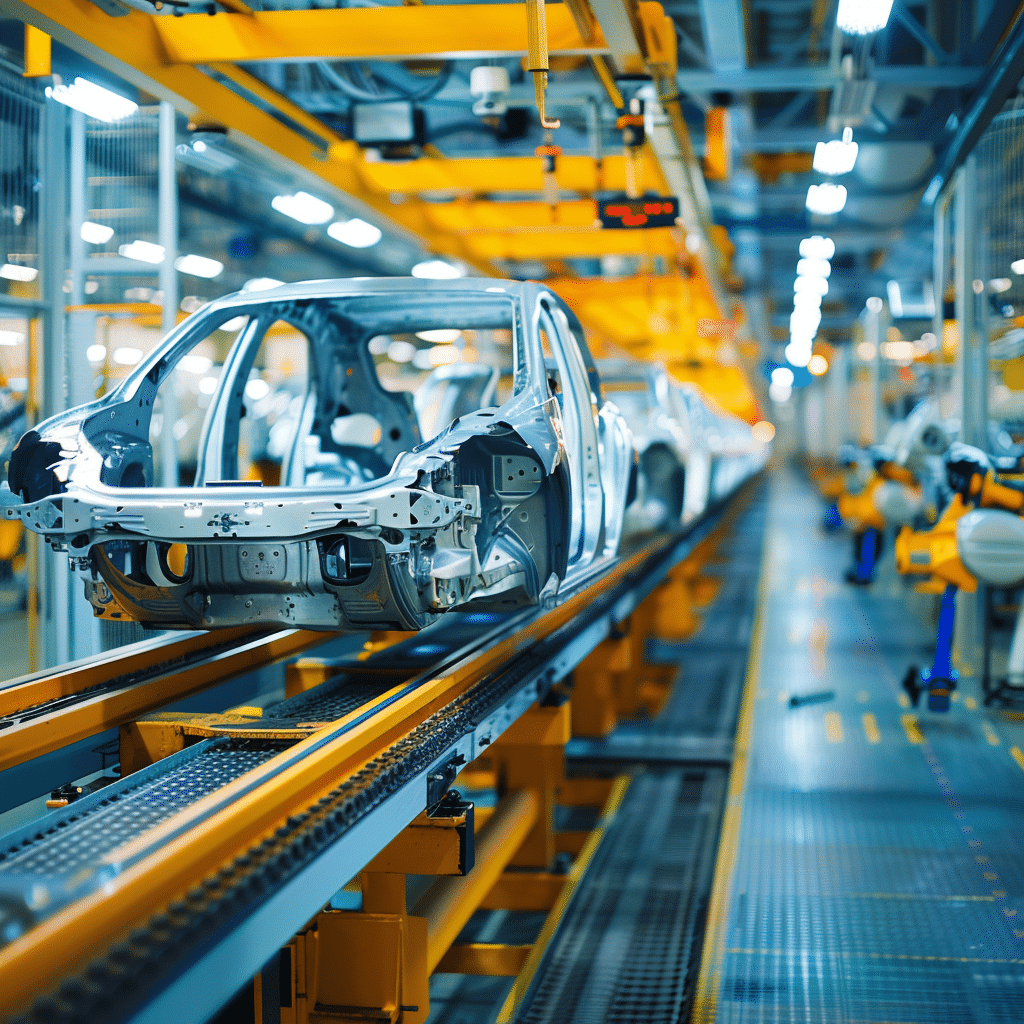

The specificity of the EURCAD pair lies in its combination of an economy oriented towards services and manufacturing (Eurozone) with an economy largely based on natural resources (Canada). This makes the pair exhibit interesting behaviors in different phases of the economic cycle and in response to global economic events.

DML Price Levels for EURCAD

The DML offering for the EURCAD pair includes several key price levels.

These levels are crucial for traders using both scalping and swing trading strategies.

In scalping, these levels can serve as precise entry and exit points in short-term transactions, often lasting from a few minutes to a few hours.

For swing traders, DML levels can be used to identify potential turning points or areas of support and resistance in a longer time frame, spanning days or even weeks.

Summary

The EURCAD currency pair offers a wide range of investment opportunities due to its specific dynamics and macroeconomic influences.

With the key DML price levels, traders have access to advanced analytical tools that support them in making more informed and effective trading decisions.

These levels can serve as reference points for setting target levels (TakeProfit), stop loss levels, or identifying potential areas of accumulation or distribution in the EURCAD currency pair.

Want more knowledge?

Plum

Plum levels are one of the key elements within the context of the so-called FlowZone – areas of liquidity changes that play a significant role in the flows of large capitals in the forex market. These levels act as resistances, although they are located much further from the current price, making them rarely reached but extremely significant in the price movement analysis for the EURCAD currency pair.