Lesson #9 - DarkOrange

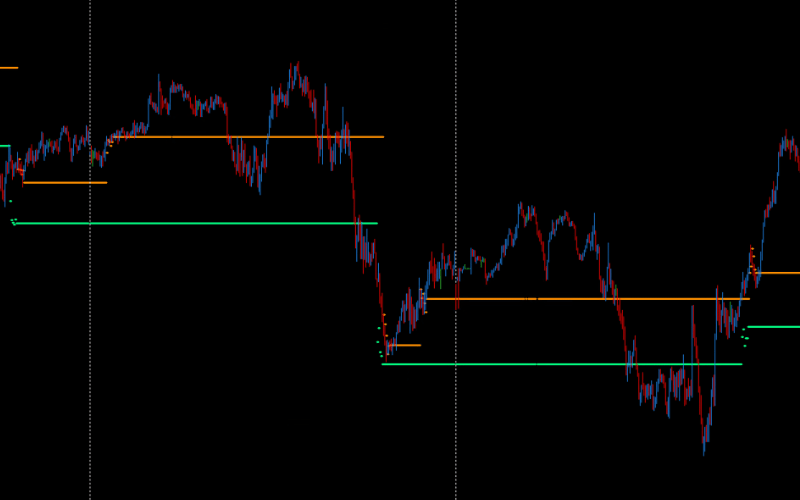

DarkOrange levels are closely linked with Violet levels, which you will learn about in the next lesson. DarkOrange levels are retrieved in 5-minute cycles throughout the day. Around 16:00 GMT, a FlowZone (FZ) appears on these levels, for which a special trading model has been prepared. These levels are represented as continuous lines between consecutive FZ zones.

Models for Trading DarkOrange Levels

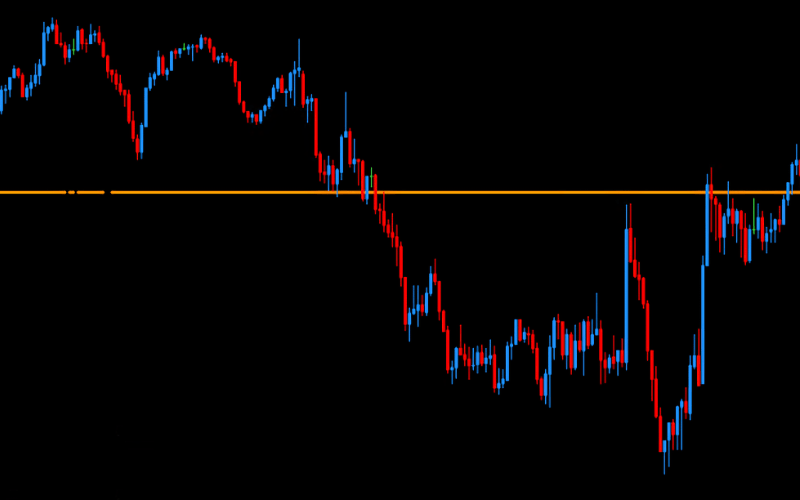

DarkOrange as Support until 06:00 GMT

These levels are excellent support during the Asian session and the beginning of the European session.

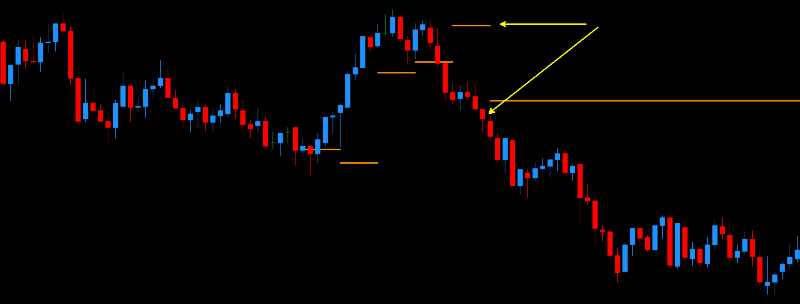

If it happens that such a level is breached by the price, the price usually returns to this level before the American session - often much earlier.

DarkOrange as Resistance until 11:00 GMT

These levels can act as resistance. This phenomenon is not very repetitive, but we describe it because trading all available DML levels on the EURCAD currency pair, such an observation can add additional points of advantage to existing trading models. More information on this can be found in the Multilevel strategy lesson.

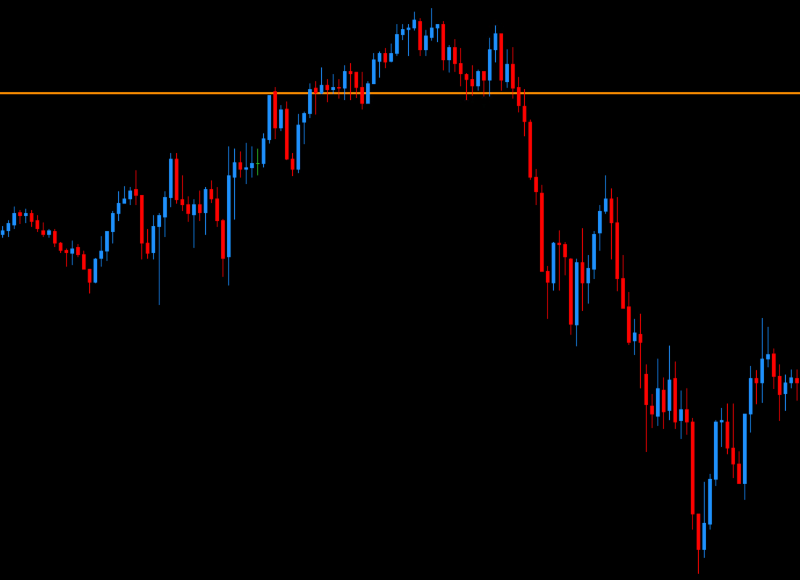

FZTP+10

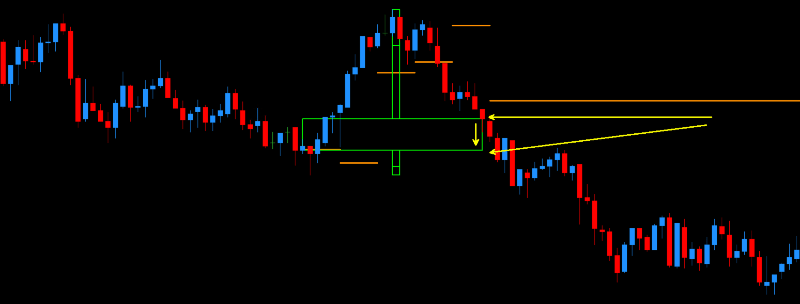

This strategy has an incredible repetitiveness. When the DarkOrange level changes its position at the end of the European session, a FlowZone (FZ) appears. It usually lasts for 25 minutes. After it ends, the DarkOrange level is drawn at a new level. The model assumes that after the DarkOrange level appears in a new place, the price should move up (BUY) from that place by at least 10 pips. If the price falls below 10 pips from this level, we expect it to return to this new DarkOrange level.

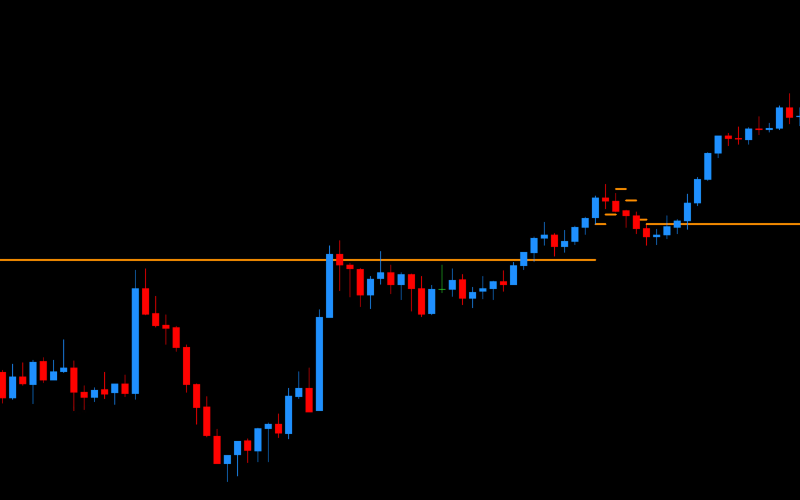

FlowZone (FZ) Settlement

At the end of the European session, a FlowZone appears. This setup has an incredible accuracy rate. To play it, follow these steps:

Check the price level when the first line within the FZ appears. Mark this price value and label it as 1.

Wait 25 minutes (the usual duration of the FlowZone). Mark this price value and label it as 2.

Look for opportunities for the price to cover the entire zone (price range) between point 1 and point 2.

This setup has over 98% accuracy. However, remember that it is not 100%, and occasionally it does not work or takes several days to realize. Such an unsettled setup can be very well used in long-term trading.

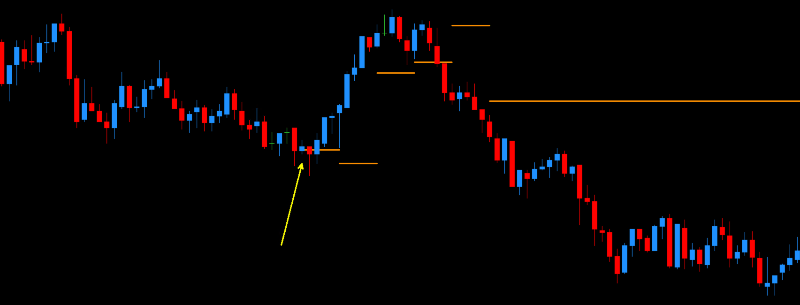

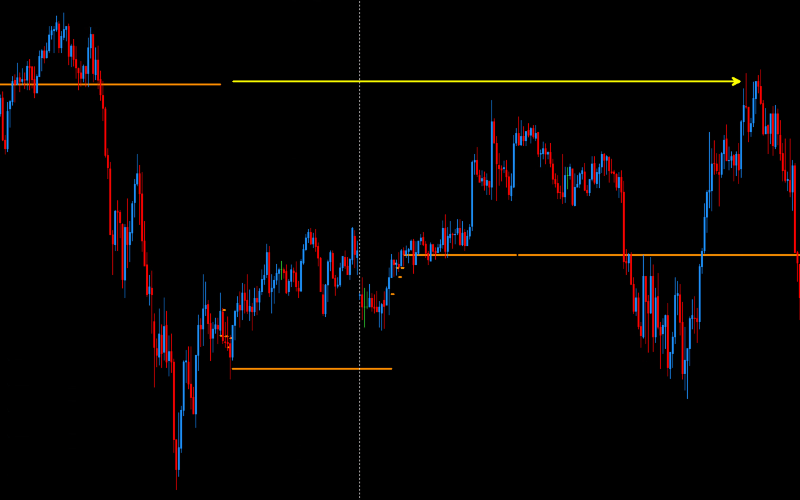

Precise Price Reaction after the DarkOrange Level Ends

During the American session, DarkOrange levels are usually not respected, but after the FlowZone, the price often returns to previous DarkOrange levels and reacts precisely to them. This phenomenon is particularly important when trading trend movements, as it allows for precise entries or adding new positions within pyramiding strategies.

Summary

DarkOrange levels, as an integral part of models related to DML levels for the EURCAD currency pair, offer unique opportunities for identifying key support and resistance points and managing risk. Their application in trading practice can significantly enhance investment efficiency, providing precise tools for analyzing and predicting market movements.

Examples of Price Reaction to DarkOrange Levels on EURCAD

Introduce your idea

If you want to test DarkOrange levels for EURCAD, we have prepared a unique offer for you.

For only 2 GBP per month, you will have access to DarkOrange levels. If you purchase these levels in advance for 6 months, the price drops to 1 GBP per month of use. Is it worth it? Find out for yourself.

Not sure? Check how the DarkOrange level builds an advantage together with other DML levels.

Advanced sets of DML levels for the EURCAD currency pair

DarkOrange

A package dedicated to beginners with no experience with DML levels.

10 GBP

50 days DarkOrange levels

Free Tools for Downloading and Visualizing DML Levels

EURCAD Edu

A complete package dedicated to those who have completed the educational process.

20 GBP

10 days Plum levels

10 days MediumOrchid levels

10 days Coral levels

10 days Khaki levels

10 days Sienna levels

10 days DeepSkyBlue levels

10 days DodgerBlue levels

10 days SpringGreen levels

10 days DarkOrange levels

20 days Violet levels

20 days Aqua levels

20 days Olive levels

40 days Red levels

40 days Magenta levels

80 days Green levels

80 days SeaGreen levels

Free Tools for Downloading and Visualizing DML Levels

EURCAD Tra

A complete package of DML levels dedicated to active traders.

60 GBP

50 days Plum levels

50 days MediumOrchid levels

50 days Coral levels

50 days Khaki levels

50 days Sienna levels

50 days DeepSkyBlue levels

50 days DodgerBlue levels

50 days SpringGreen levels

50 days DarkOrange levels

60 days Violet levels

60 days Aqua levels

60 days Olive levels

120 days Red levels

120 days Magenta levels

200 days Green levels

200 days SeaGreen levels

Free Tools for Downloading and Visualizing DML Levels

Note: The content of the data packages offered on DeepMarketLevel.com may be greater than what is published on this page. Check the current available offer and always stay one step ahead of other market participants.

Want more knowledge?

SpringGreen

SpringGreen levels are very good support from the beginning of the Asian session until about two hours before the start of the American session. For short-term trading, this is a considerably long period to wait for the price to return to this level.

Violet

Violet levels are very similar to DarkOrange levels, with the difference being that Violet levels are determined on an hourly basis. The trading models are similar, but in this case, there is no designation of a FlowZone (FZ).