Lesson #3 - MediumOrchid - Resistance

MediumOrchid levels are another crucial element within the context of the so-called FlowZone – areas of liquidity changes that play a significant role in the flows of large capitals in the forex market. These levels act as resistances, being closer to the current price compared to Plum levels, making them more frequently reached and equally significant in the price movement analysis for the EURCAD currency pair. This level is published in 5-minute cycles. The level acts as resistance in areas where it appears as a "solid line," but historical data shows that its optimal effectiveness is until 11:00 AM GMT.

Characteristics of MediumOrchid Levels

MediumOrchid levels, as part of the DML levels for the EURCAD currency pair, are characterized by similar precision in price reaction as Plum levels. When the price approaches these levels, it often results in a notable rebound, emphasizing their significance as strong points of resistance. In cases where the price breaches the MediumOrchid level, there is a significant probability – according to repetitive statistical models – that the price will return to this level. Such dynamics demonstrate the dominant strength of these levels in determining potential future price movements.

Models for Trading MediumOrchid Levels

There are two main models for utilizing MediumOrchid levels in trading strategies:

Reaction to the Level: This model involves observing and reacting to the price approaching the MediumOrchid level. Traders expect the price to bounce off this level, presenting an opportunity to enter a trade in the direction of the rebound. This strategy is particularly effective in short-term time frames, where the precision of price reaction plays a crucial role.

Return to the Level after Breach: In situations where the price breaches the MediumOrchid level, this model assumes that the price will return to this level with high probability. This strategy is useful in long-term analyses, where predicting the return to significant resistance levels can significantly enhance risk and capital management efficiency.

Additional Tips

MediumOrchid levels can also provide additional insights in the context of trend analysis and utilization. If the market trend is downward – determined, for example, according to the MMD methodology models (which will be covered in subsequent lessons) – and the price approaches the MediumOrchid level, it presents an excellent opportunity to take a SELL position in line with the dominant trend. Furthermore, the presence of other DML levels below MediumOrchid may indicate the possibility of a deeper correction, making the strategy even more comprehensive and adaptable to changing market conditions.

Summary

MediumOrchid levels, as an integral part of models related to DML levels for the EURCAD currency pair, offer unique opportunities for identifying key points of resistance and managing risk. Their application in trading practice, both in short-term and long-term strategies, can significantly enhance investment efficiency, providing precise tools for analyzing and predicting market movements.

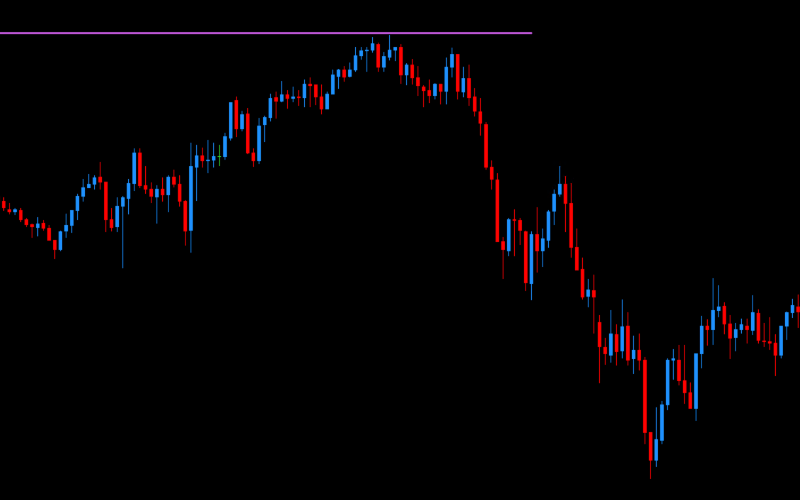

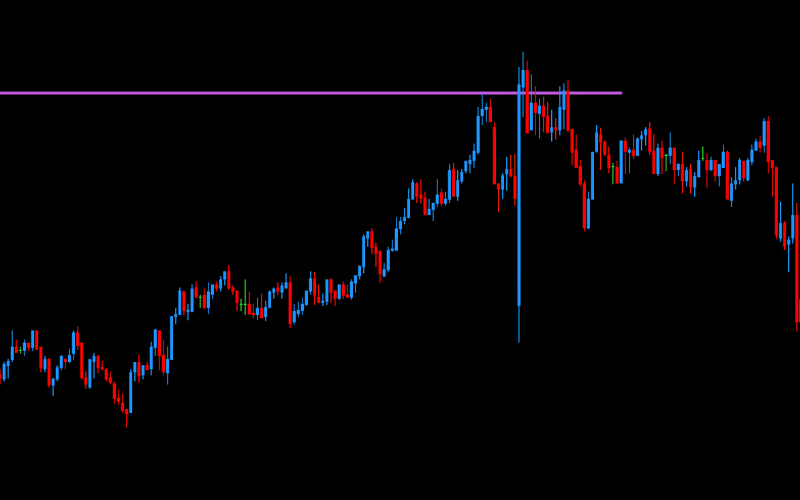

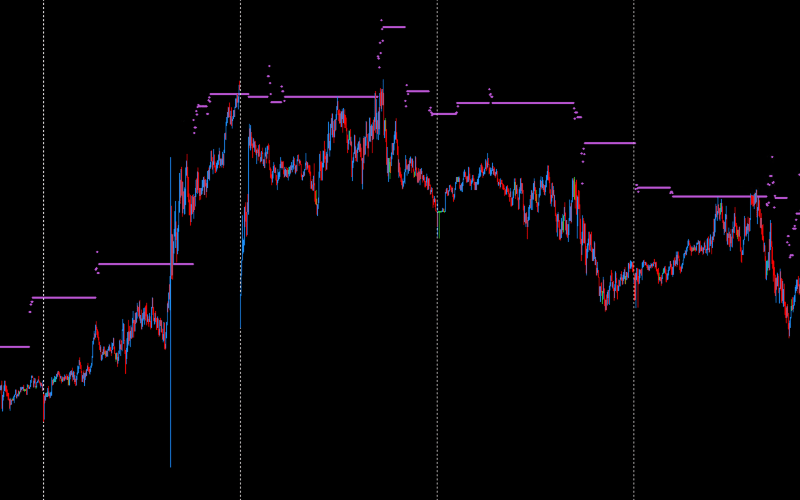

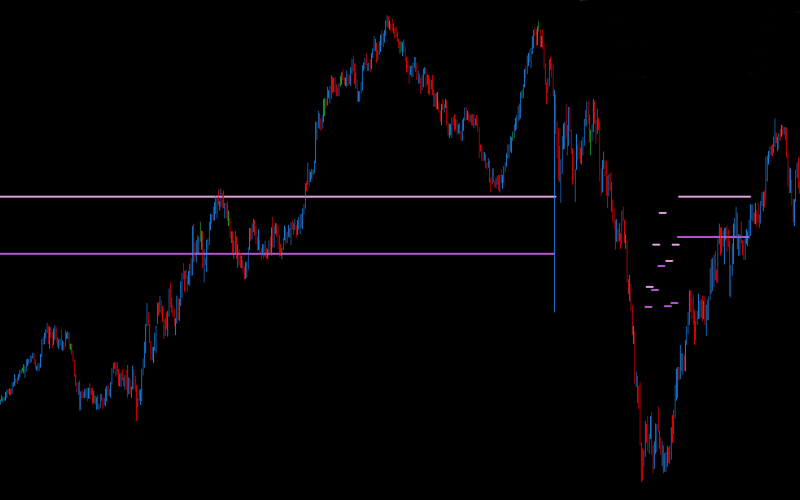

Examples of Price Reaction to MedOrchid Levels on EURCAD

Introduce your idea

If you want to test MediumOrchid levels for EURCAD, we have prepared a unique offer for you.

For only 2 GBP per month, you will have access to MediumOrchid levels. If you purchase these levels in advance for 6 months, the price drops to 1 GBP per month of use. Is it worth it? Find out for yourself.

Not sure? Check how the MediumOrchid level builds an advantage together with other levels from the "Flow Zone" gr_oup.

Advanced sets of DML levels for the EURCAD currency pair

MedOrchid

A package dedicated to beginners with no experience with DML levels.

10 GBP

50 days MedOrchid levels

Free Tools for Downloading and Visualizing DML Levels

EURCAD Edu

A complete package dedicated to those who have completed the educational process.

20 GBP

10 days Plum levels

10 days MediumOrchid levels

10 days Coral levels

10 days Khaki levels

10 days Sienna levels

10 days DeepSkyBlue levels

10 days DodgerBlue levels

10 days SpringGreen levels

10 days DarkOrange levels

20 days Violet levels

20 days Aqua levels

20 days Olive levels

40 days Red levels

40 days Magenta levels

80 days Green levels

80 days SeaGreen levels

Free Tools for Downloading and Visualizing DML Levels

EURCAD Tra

A complete package of DML levels dedicated to active traders.

60 GBP

50 days Plum levels

50 days MediumOrchid levels

50 days Coral levels

50 days Khaki levels

50 days Sienna levels

50 days DeepSkyBlue levels

50 days DodgerBlue levels

50 days SpringGreen levels

50 days DarkOrange levels

60 days Violet levels

60 days Aqua levels

60 days Olive levels

120 days Red levels

120 days Magenta levels

200 days Green levels

200 days SeaGreen levels

Free Tools for Downloading and Visualizing DML Levels

Note: The content of the data packages offered on DeepMarketLevel.com may be greater than what is published on this page. Check the current available offer and always stay one step ahead of other market participants.

Want more knowledge?

Plum

Plum levels are one of the key elements within the context of the so-called FlowZone – areas of liquidity changes that play a significant role in the flows of large capitals in the forex market. These levels act as resistances, although they are located much further from the current price, making them rarely reached but extremely significant in the price movement analysis for the EURCAD currency pair.

Coral

Coral levels are a key component within the context of the so-called FlowZone – areas of changing liquidity that play a significant role in the flow of large capitals in the forex market.

These levels act as resistances and are closer to the current price than Plum and MediumOrchid levels. Price interactions with Coral levels are more frequent, and these levels are often breached.