Lesson #00 - DeepSkyBlue - Support

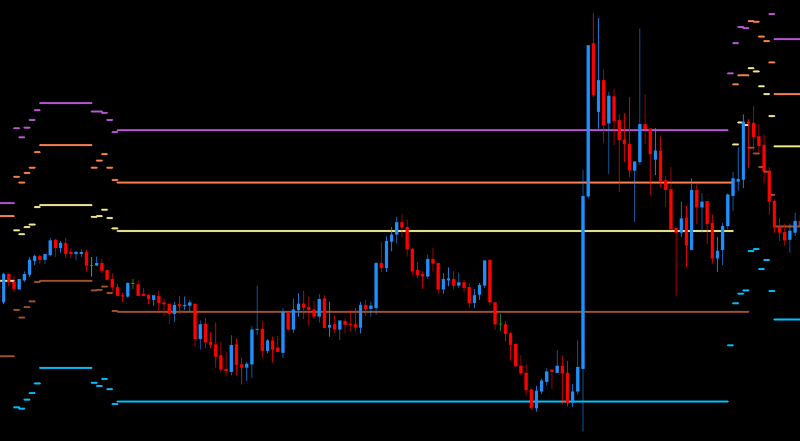

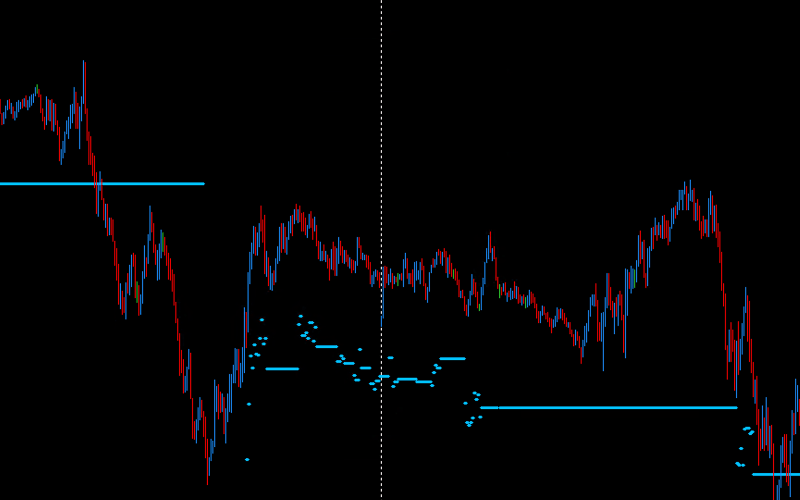

DeepSkyBlue levels are a support level located further from the current price, similar to the MediumOrchid level – which is a resistance – but below the price. These levels play a crucial role in maintaining the price above this level, providing solid support in medium- and long-term time frames. This level is published in 5-minute cycles. The level acts as support in areas where it appears as a "solid line," but historical data shows that its optimal effectiveness is until 11:00 AM GMT.

Characteristics of DeepSkyBlue Levels

DeepSkyBlue levels, as part of the DML levels for currency pairs, are characterized by clear price reactions upon reaching them. When the price approaches the DeepSkyBlue level, it often finds solid support, preventing further declines and initiating potential bounces. Such dynamics highlight the critical role of these levels in stabilizing the market and supporting the price in medium- and long-term perspectives.

Strategies for Trading DeepSkyBlue Levels

There are two main models for utilizing DeepSkyBlue levels in trading strategies:

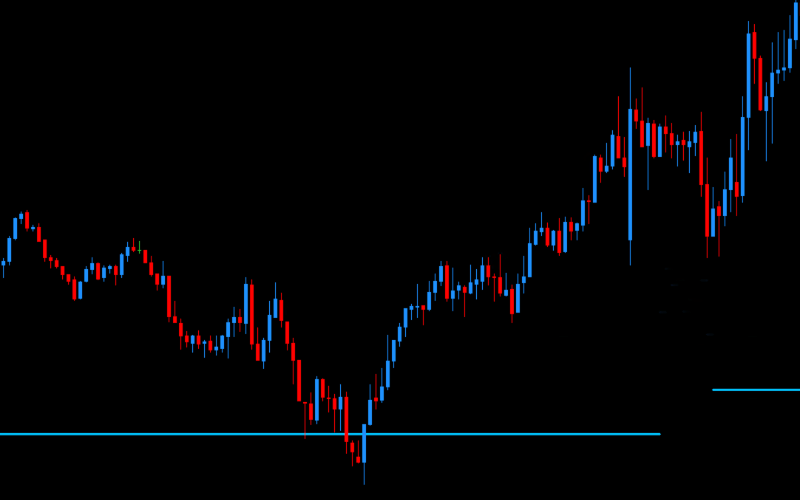

Bounce from Support Level: This strategy involves observing the price as it approaches the DeepSkyBlue level and opening a long position (BUY) upon a bounce. Traders expect the price to bounce off the DeepSkyBlue level, creating an opportunity to enter a trade in the direction of the bounce.

Return to Breached Support: In situations where the price breaches the DeepSkyBlue level, this strategy assumes a return to the breached support level. This strategy is useful in medium- and long-term analyses where confirming support can significantly improve risk and capital management.

Summary

DeepSkyBlue levels, as an integral part of models related to DML levels for currency pairs, offer unique opportunities for identifying key support points and managing risk. Their application in trading practice can significantly enhance investment efficiency, providing precise tools for analyzing and predicting market movements.