Lesson #5 - Olive

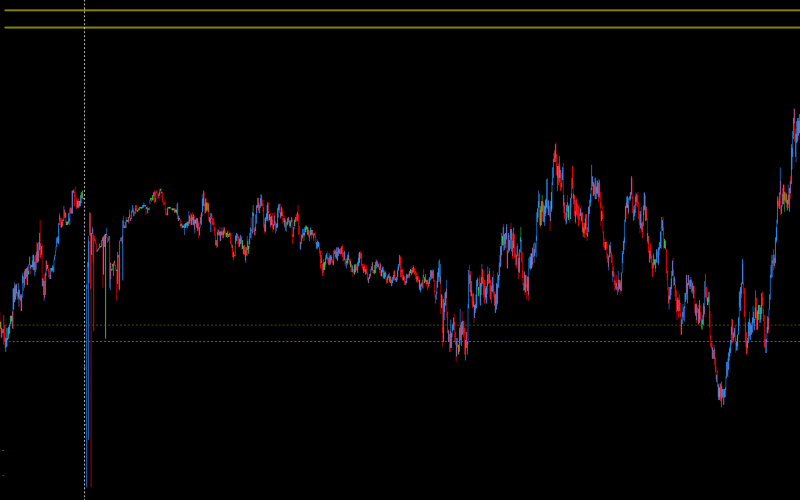

Olive levels are generated once a day, around 19:00 GMT. This level consists of three zones. The middle zone is located around the price level at 19:00 GMT. The other two zones are located above and below the middle zone, at equal distances from it. The range of these distances varies daily and indicates the potential movement dynamics for the next day. The lower zone is a very strong support for the next trading day, while the upper zone is a strong resistance for the next trading day.

Characteristics of Olive Levels

Olive levels, part of the DML levels for currency pairs, have unique properties. If the price breaks through the lower or upper zone before the American session - which happens very rarely - we expect the price to return to this level. The middle zone of Olive is also very important. The price often returns to this level on the next trading day, making it a very precise reaction level.

Models for Trading Olive

Olive as Support

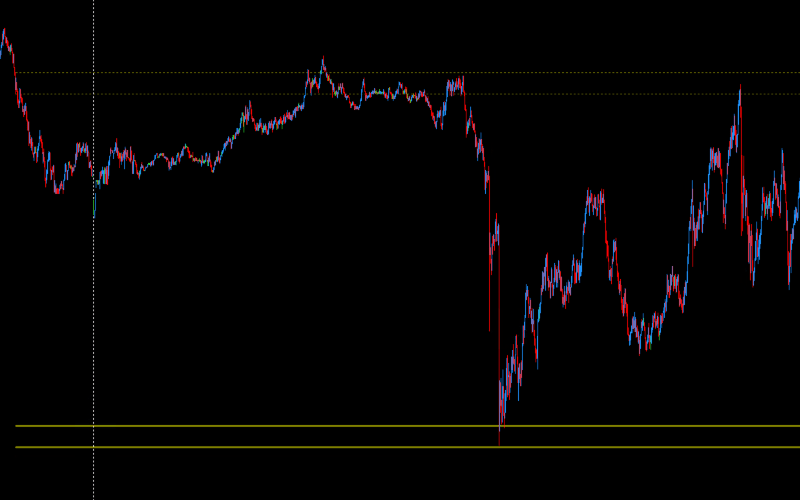

The lower zone of the Olive level acts as strong support for the next trading day. If the price approaches this zone, traders can expect this level to prevent further price declines, creating an opportunity to open long positions (BUY).

Olive as Resistance

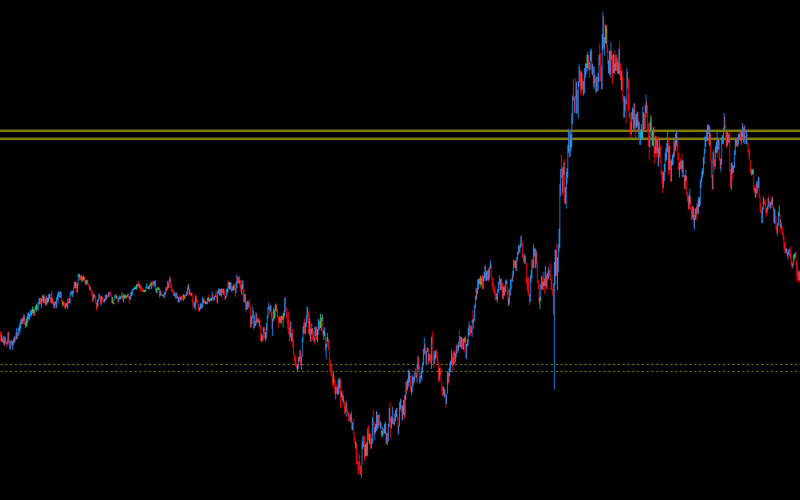

The upper zone of the Olive level acts as strong resistance for the next trading day. If the price approaches this zone, traders can expect this level to prevent further price increases, creating an opportunity to open short positions (SELL).

Additional Tips

If the new level is not reached during the Asian session, it should be reached during the European or American session. If the middle zone is not reached during the Asian and European sessions, the likelihood of reaching this level during the American session increases significantly. This level, especially the middle zone, is a key reaction point that can be used for precise entries into positions.

Summary

Olive levels, as an integral part of models related to DML levels for currency pairs, offer unique opportunities for identifying key support and resistance points and managing risk. Their application in trading practice can significantly enhance investment efficiency, providing precise tools for analyzing and predicting market movements.