Lesson #5 - Khaki - Resistance

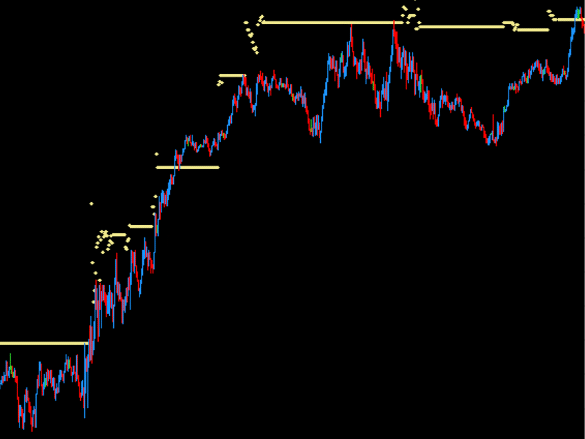

Khaki levels are among the most effective resistance points relative to the current price, making them equally frequently reached and breached. Their unique feature is the high repeatability of returns to these levels after being breached. When these levels remain unsettled for a longer period, they become key reference points for future market movements, initiating new swings, corrections, or waves upon resolution. These levels are published in 5-minute cycles, and their optimal effectiveness occurs until 11:00 AM GMT.

Characteristics of Khaki

Khaki levels on various currency pairs are frequently reached and breached. Their unique feature is the high repeatability of returns to these levels after being breached. When these levels remain unsettled for a longer period, they become key reference points for future market movements, initiating new swings, corrections, or waves upon resolution. These levels are published in 5-minute cycles, and their optimal effectiveness occurs until 11:00 AM GMT.

Models for Trading Khaki

There are two main models for trading Khaki levels:

Reaction to the Level: This strategy involves observing the price as it approaches the Khaki level and reacting to its rebound. Traders expect the price to bounce off the Khaki level, creating an opportunity to enter a trade in the direction of the rebound. This strategy is particularly effective in short-term time frames where precise price reactions are crucial.

Return to the Level after Breach: When the price crosses the Khaki level, this strategy assumes that the price will return to this level with a high probability. This strategy is useful in long-term analyses where predicting the return to key resistance levels can significantly improve risk and capital management.

Additional Tips

Khaki levels also provide valuable insights in the context of trend analysis. They are particularly useful during the Asian session and the early part of the European session. If Khaki levels remain unresolved for a longer period, they become important market levels from which new price movements such as swings, corrections, or waves often begin. Furthermore, these levels often coincide with significant Fibonacci retracements, indicating their potential for measuring price movement ranges.

Summary

Khaki levels, as an integral part of models related to DML levels, offer unique opportunities for identifying key resistance points and managing risk. Their use in both short-term and long-term trading strategies can significantly enhance investment efficiency, providing precise tools for analyzing and predicting market movements.