Lesson #3 - Red & Magenta

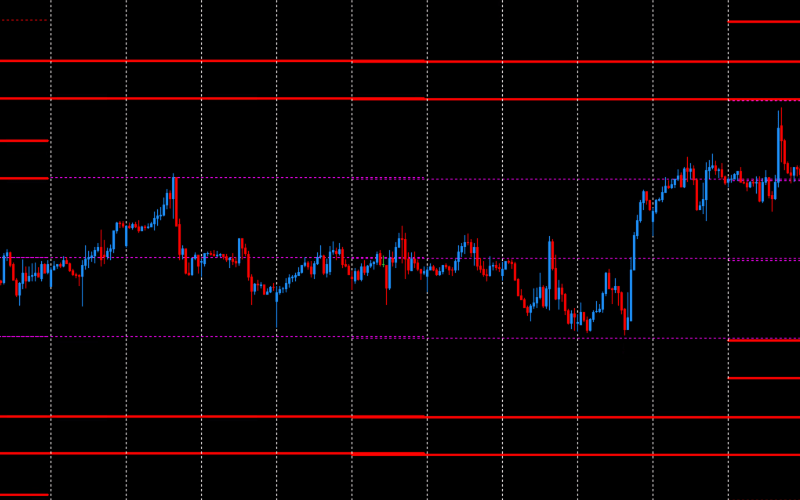

Red levels are weekly supports and resistances. They appear on the chart on Wednesday afternoons and remain valid for the following week. Red levels consist of a total of six horizontal lines: three above the price and three below. The main Red levels, known as RedEx, are located at the extreme positions - both at the bottom and top. Approximately one-quarter of the distance between the lower and upper RedEx levels, the Red levels create a zone marked by two bold lines, both above and below the price.

Characteristics of Red Levels

Red levels, part of the DML levels for currency pairs, are determined once a week on Wednesday afternoons. Their validity lasts for the entire week until the next Wednesday when new levels are determined. These levels act as strong supports and resistances, significantly influencing price movements in the market.

Models for Trading Red

Red as Support

Red levels that act as support are crucial for maintaining the price above a certain level throughout the week. Traders can use these levels to open long positions (BUY) when the price approaches the Red support, expecting a rebound and price increase.

Red as Resistance

Red levels that act as resistance serve as important points where the price may struggle to rise further. Traders can use these levels to open short positions (SELL) when the price approaches the Red resistance, expecting a rebound and price decline.

Models for Trading Red

Transaction Models on Red Levels

On Red levels - those zones closer to the price - we typically play three transaction models:

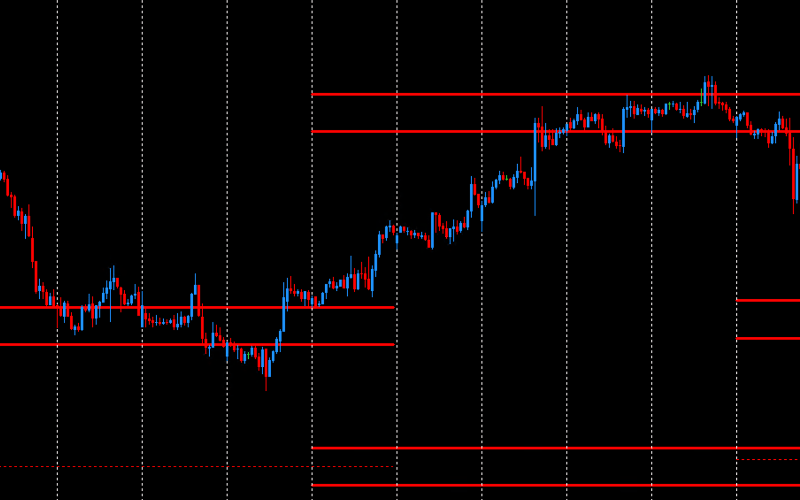

Price reaction at the Red level and direction change: A strategy involving observing the price approaching the Red level and expecting a rebound.

Consolidation at the Red level: The price oscillates within the zone marked by two bold lines, creating an opportunity to play positions in a short range.

Breakthrough of the Red zone and return: After breaking through the Red zone, the price often reaches the RedEX level and then returns to the Red level.

Additional Tips

Red levels are updated weekly, meaning traders should regularly monitor new levels on Wednesday afternoons to adjust their trading strategies. The price does not often reach the Red levels, but when it does, it is an excellent setup to play, especially in combination with other DML levels, which you will learn more about in the upcoming lessons.

Summary

Red levels, as an integral part of models related to DML levels for currency pairs, offer unique opportunities for identifying key support and resistance points and managing risk in long-term trading strategies. Their application can significantly enhance investment efficiency, providing precise tools for analyzing and predicting market movements over the course of a week.

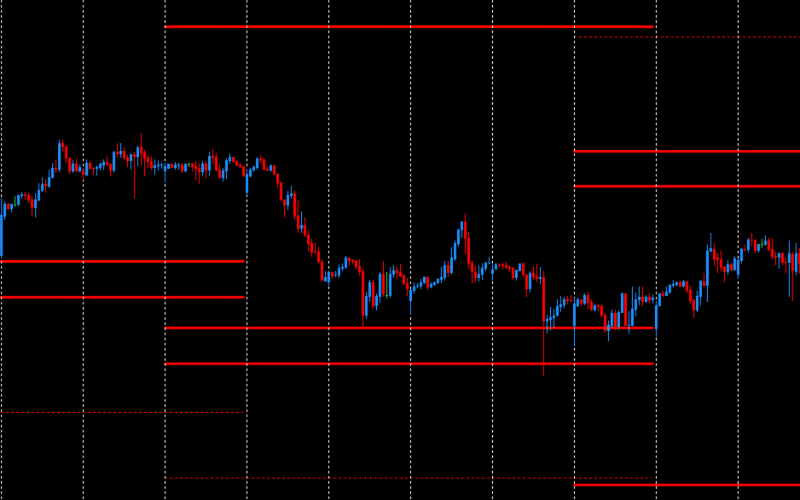

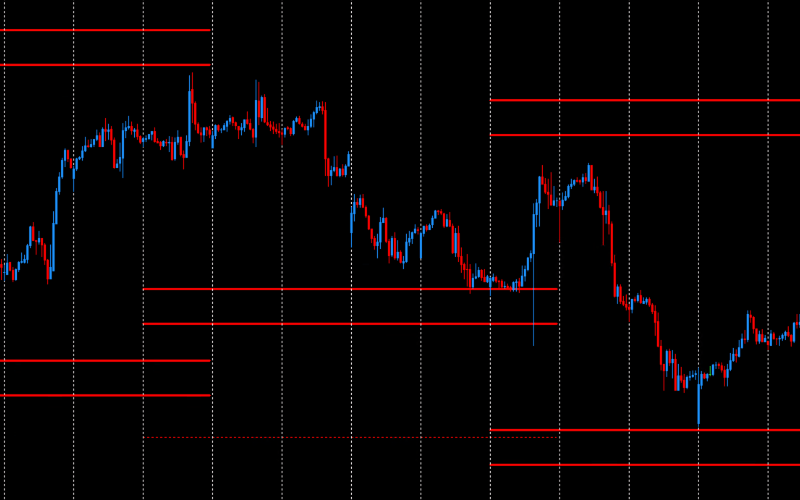

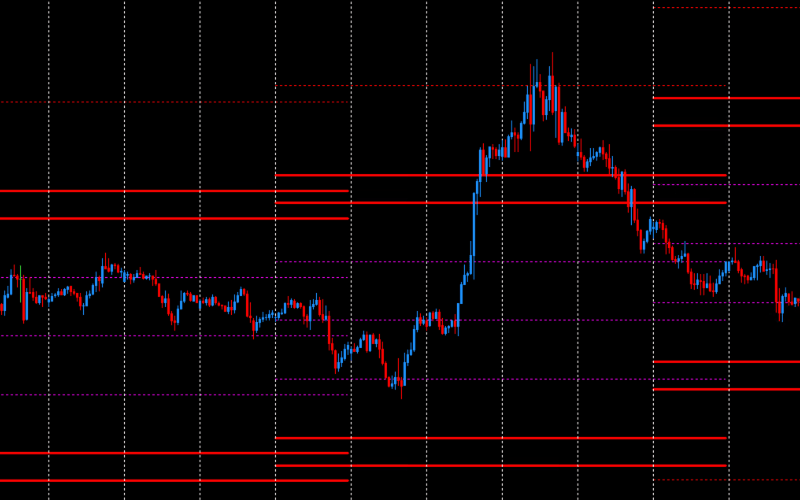

Examples of Price Reaction to Red Levels

Magenta Levels

Description of Magenta Levels

Magenta levels are three dashed lines that are determined in the same way as Red levels. Magenta levels divide the space between Red levels into four equal quarters. It is expected that the price will react to the Magenta levels, making them an important element in analysis and trading strategies.

Additional Tips

The Magenta level is very often reached by the price after the period separator appears at the close of the Wednesday trading day. This is a key moment that traders should consider in their strategies, as price reactions to the Magenta level can provide valuable insights into future price movements.

Summary

Magenta levels, as an integral part of models related to DML levels for currency pairs, offer unique opportunities for identifying key turning points and managing risk. Their application in trading practice can significantly enhance investment efficiency, providing precise tools for analyzing and predicting market movements.