Lesson #6 - Violet

Violet levels are very similar to DarkOrange levels, with the difference being that Violet levels are determined based on the analysis of provided data in hourly cycles. This results in greater inertia compared to DarkOrange levels, which are much more precise and show possible anomalies more quickly. The trading models are similar, but in the case of Violet levels, a FlowZone (FZ) is not designated.

Characteristics of Violet

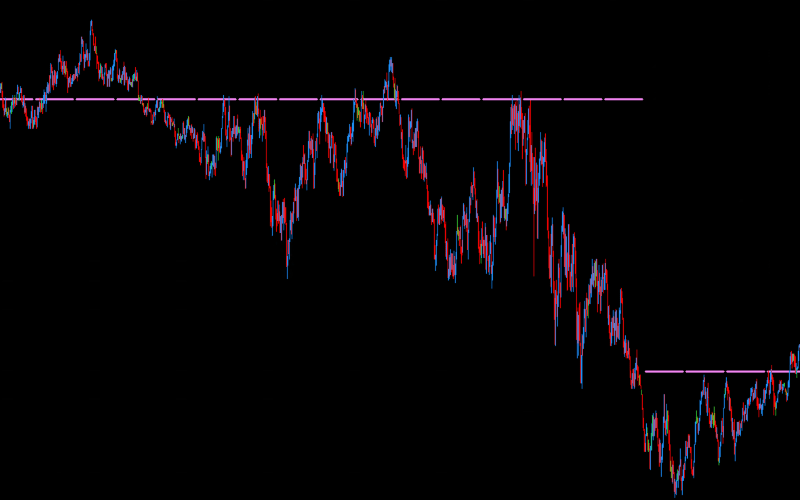

Violet levels, part of the DML levels for currency pairs, are characterized by precise price reactions when reached. When the price approaches a Violet level, it often finds solid support or resistance, preventing further declines or increases.

This dynamic highlights the critical role of these levels in stabilizing the market and supporting the price in short-term perspectives.

Models for Trading Violet

Violet levels can serve as significant support or resistance, depending on the currency pair they appear in, especially in the context of the US dollar (USD). It is important whether USD is the first (base currency) or the second (quote currency) component of the currency pair.

For currency pairs where USD is the first currency (e.g., USDCAD, USDCHF, USDJPY):

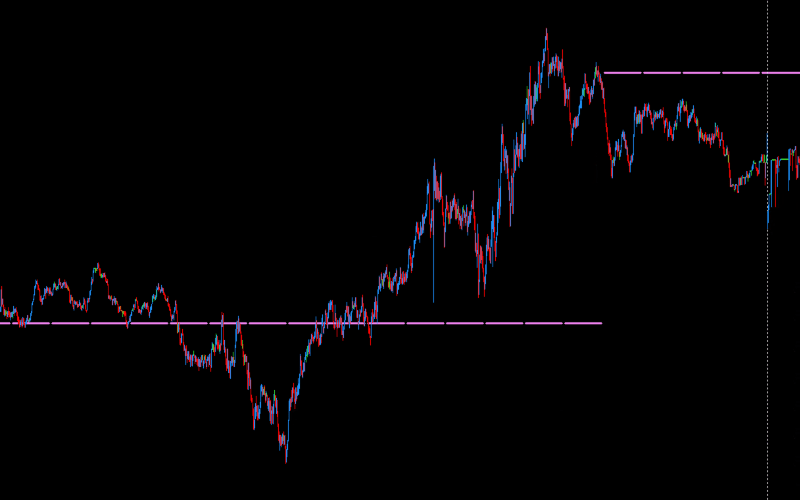

Violet as Support until 11:00 GMT

The Violet level serves as significant support during the Asian session and the early part of the European session. If this level is breached before 11:00 GMT, there is a high probability that the price will return to this level in the near future - often the same day, just before or during the American session.

For currency pairs where USD is the second currency (e.g., AUDUSD, EURUSD, GBPUSD):

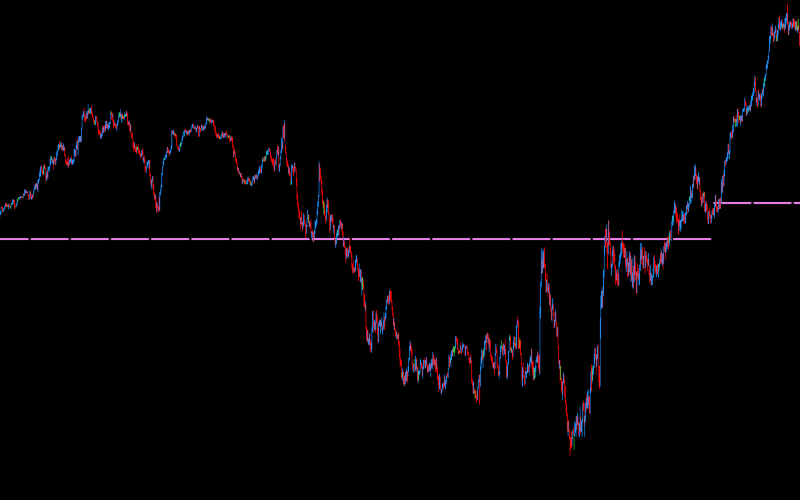

Violet as Strong Resistance until 11:00 GMT

In this case, the Violet level acts as strong resistance. If this level is breached before 11:00 GMT, the probability of the price returning to this level in the near future increases significantly - often the same day, just before or during the American session.

Additional Tips

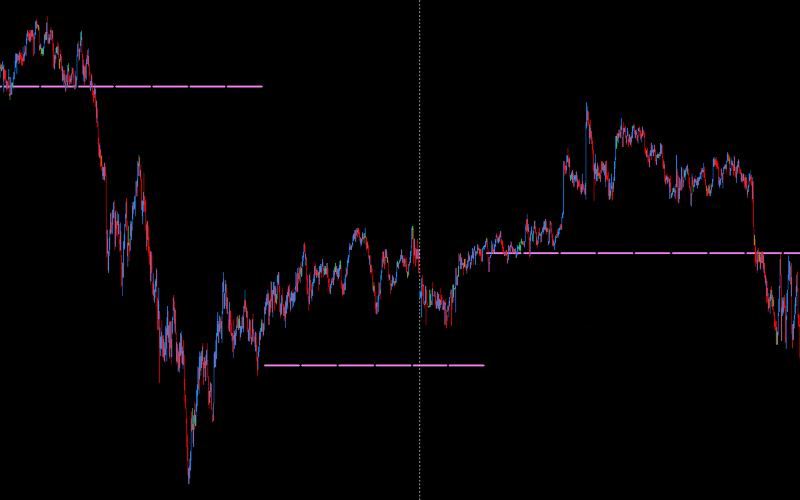

Precise Retests: When retesting the Violet level, the price usually does so very precisely, allowing for accurate entries in line with the established trend.

No FlowZone: Despite the absence of a designated FlowZone, Violet levels are extremely important for stabilizing the price and predicting market movements.

Data Delivery Cycles: Violet levels are provided to clients in hourly cycles. It should be noted that these cycles are not related to the traditionally understood intervals of financial market observation but are simply the frequency of data updates.

Summary

Violet levels, as an integral part of models related to DML levels for currency pairs, offer unique opportunities for identifying key support and resistance points and managing risk.

By considering the specifics of currency pairs involving the US dollar, traders can adjust their strategies to enhance investment efficiency and precision in market analysis.

However, it is important to note that Violet levels are also calculated for other currency pairs not involving the US dollar. On these pairs, Violet levels serve as support, resistance, and also as levels that the price often "touches" during its volatility.

Therefore, Violet levels are a universal tool that can be applied across various markets and trading conditions.