Lesson #2 - SeaGreen & Green

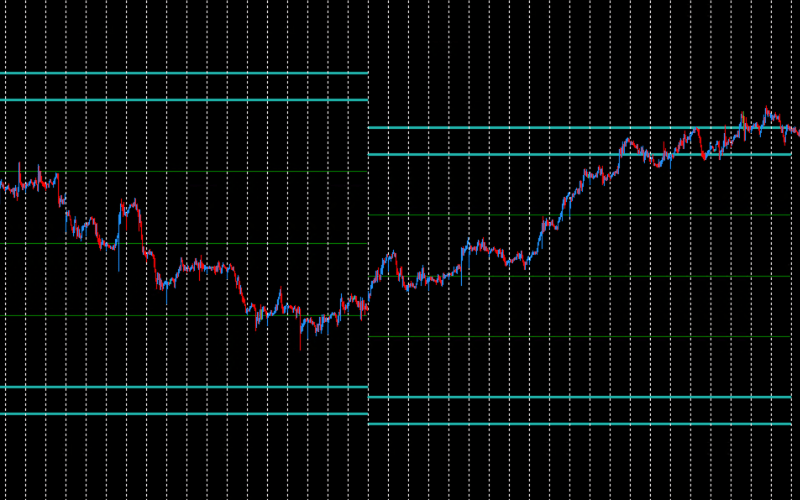

SeaGreen levels are monthly supports and resistances set at the beginning of each calendar month. The price rarely reaches these levels, but when it does, it usually either changes direction long-term or consolidates at that level. This makes it an ideal level for investors and traders who position their trades over a longer time frame.

Characteristics of SeaGreen

SeaGreen levels, part of the DML levels for currency pairs, are determined once a month and provide key reference points for long-term analysis. These levels act as strong supports and resistances that can significantly influence the direction of price movements throughout the month.

Green levels complement SeaGreen levels by dividing the space between the lower and upper SeaGreen levels into four quarters. When the market does not exhibit very dynamic movements within a month, it often stops at Green levels.

Models for Trading SeaGreen

SeaGreen as Support

SeaGreen levels that act as support are crucial for maintaining the price above a certain level throughout the month. Traders can use these levels to open long positions (BUY) when the price approaches the SeaGreen support, expecting a rebound and price increase.

SeaGreen as Resistance

SeaGreen levels that act as resistance serve as important points where the price may struggle to rise further. Traders can use these levels to open short positions (SELL) when the price approaches the SeaGreen resistance, expecting a rebound and price decline.

Consolidation at SeaGreen Level

When the price reaches the SeaGreen level, it often consolidates. The price oscillates around this level, creating opportunities for short-term trades with long-term benefits.

Additional Tips

SeaGreen and Green levels are determined once a month, meaning traders should regularly monitor these levels at the beginning of each month to adjust their trading strategies. The price rarely reaches SeaGreen and Green levels, but when it does, these are excellent setups to play, especially in combination with other DML levels.

Summary

SeaGreen and Green levels, as an integral part of models related to DML levels for the EURCAD currency pair, offer unique opportunities for identifying key support and resistance points and managing risk in long-term trading strategies. Their application can significantly enhance investment efficiency, providing precise tools for analyzing and predicting market movements over the course of a month.