Lesson #7 - DarkOrange

DarkOrange levels are closely linked to Violet levels, which are updated every hour, unlike DarkOrange levels, which are updated every 5 minutes. Both the data sources and calculation algorithms are identical. However, the more frequent 5-minute recalculations for DarkOrange levels have allowed the discovery of unique setups and models, as well as the observation of many anomalies unavailable for trading on Violet levels.

Violet levels provide a more general market overview and price balancing,

while DarkOrange levels enable precise identification of critical turning points.

Models for Trading DarkOrange Levels

DarkOrange levels (similar to Violet) can act as significant support or resistance, depending on the currency pair they appear in, particularly in the context of the US dollar (USD). It is essential whether USD is the first (base currency) or the second (quote currency) in the currency pair.

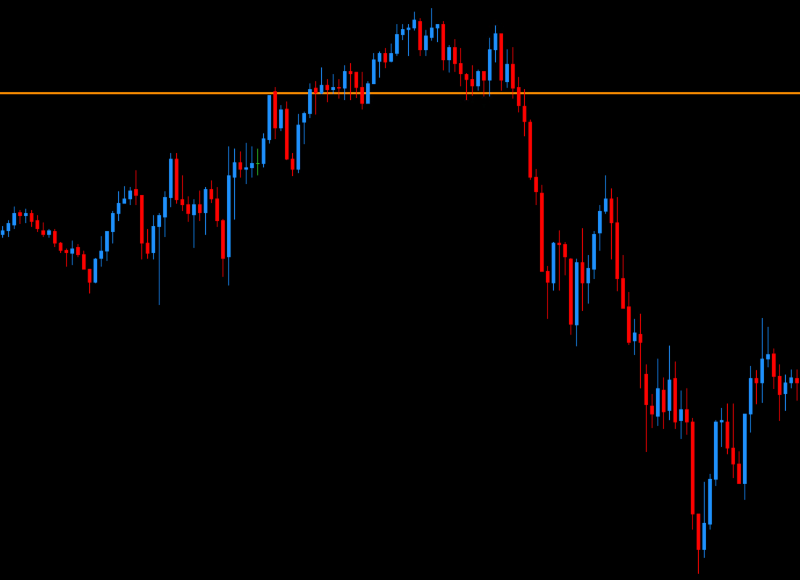

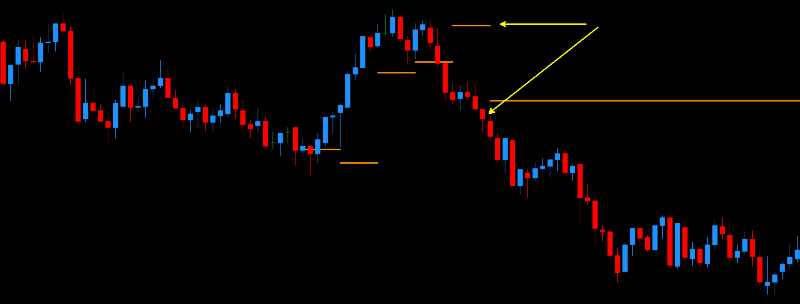

For currency pairs where USD is the second currency (e.g., AUDUSD, EURUSD, GBPUSD):

The DarkOrange level serves as strong resistance until 12:00 GMT. If this level is breached before 12:00 GMT, the probability of the price returning to this level increases significantly - often the same day, before or during the American session.

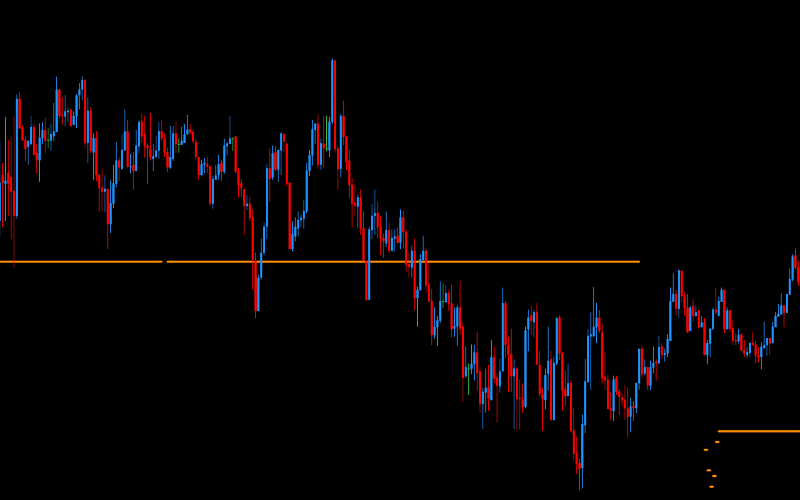

For currency pairs where USD is the first currency (e.g., USDCAD, USDCHF, USDJPY):

The DarkOrange level serves as significant support until 12:00 GMT, particularly during the Asian and early European sessions. If this level is breached before 12:00 GMT, there is a high probability that the price will return to this level in the near future - often the same day, before or during the American session.

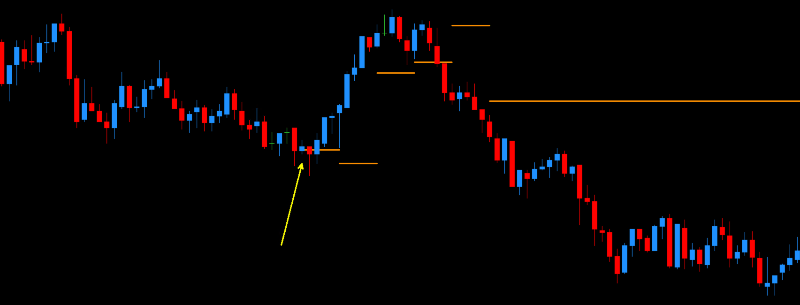

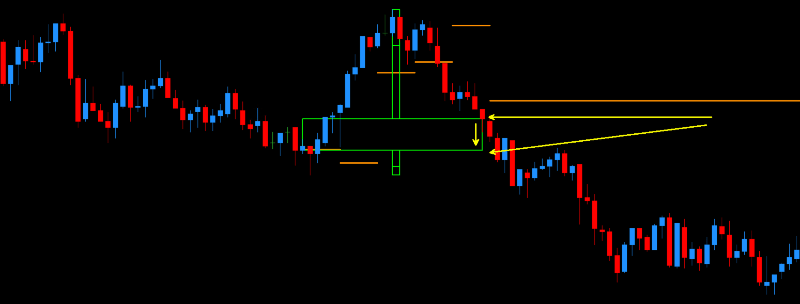

FlowZone (FZ) Settlement

On some currency pairs, a FlowZone appears at the DarkOrange levels, characterized by high accuracy. To use this setup, follow these steps:

Check the price level when the first line within the FZ appears. Mark this price value and label it as 1.

Wait 25 minutes (the usual duration of the FlowZone). Mark this price value and label it as 2.

Look for opportunities for the price to cover the entire zone (price range) between point 1 and point 2.

This setup has over 98% accuracy. However, remember that it is not 100%, and occasionally it does not work or takes several days to realize. Such an unsettled setup can be very well used in long-term trading.

Note: The Flow Zone Candle indicator can assist in automatically identifying Flow Zone areas, which you can download from the Download section (in the client panel on DeepMarketLevel.com). A detailed description of its functionality and configuration can be found on our educational page, under the section covering tools that support trading with DML levels.

Summary

DarkOrange levels, as an integral part of models related to DML levels for currency pairs, offer unique opportunities for identifying key support and resistance points and managing risk. Their application in trading practice can significantly enhance investment efficiency, providing precise tools for analyzing and predicting market movements.