Lesson #15 - Aqua

Aqua levels, similar to Violet levels, are retrieved every hour, although their characteristics are quite different. Violet levels, for reference, typically hold one level throughout most of the day, then shift to a new level in the evening after the Flow Zone (FZ). In contrast, Aqua levels usually appear near the current price level.

We have several models for trading Aqua levels:

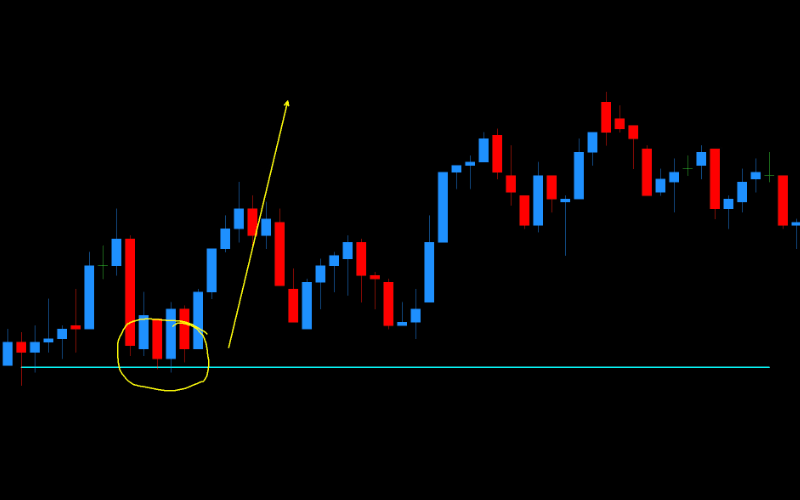

Reaction to Aqua Level During Its Duration

If the price reaches the Aqua level during its duration, we expect a reaction around 5 pips.

If the level is breached, and the reaction strategy fails, we expect the price to retest this level in the future.

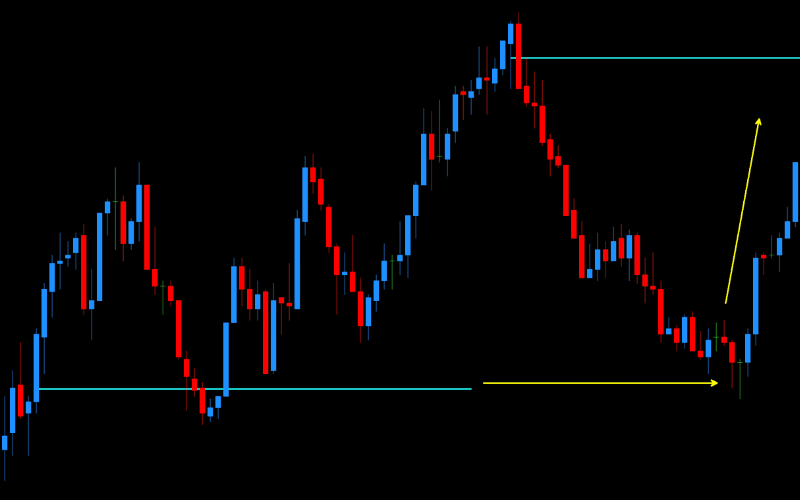

Reaction to Aqua Level After Its Duration

In a strong trend, these levels often do not get retested. This is an important "future" signal, as during a price correction, there is a strong tendency for Aqua levels to cause reactions after their duration has ended. Similarly, if such a level does not react initially, we expect it to be tested later.

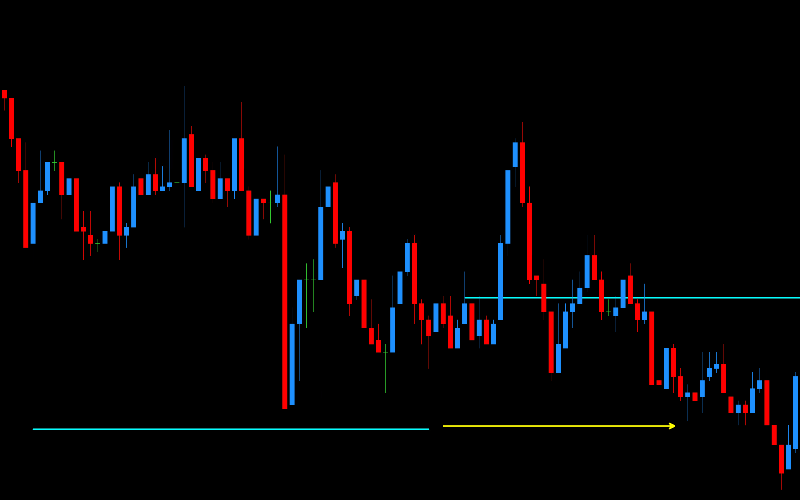

Approaching a "Floating" Aqua

Sometimes, the Aqua level does not intersect with the current price. We call these "floating levels." Statistics show that a significant majority of such floating levels are resolved in the future. However, in the case of a strong trend with multiple floating levels, it is advisable to wait for a trend reversal before taking a position. We discussed trend reversal and price direction in the lesson on combining DML levels with the MMD methodology.

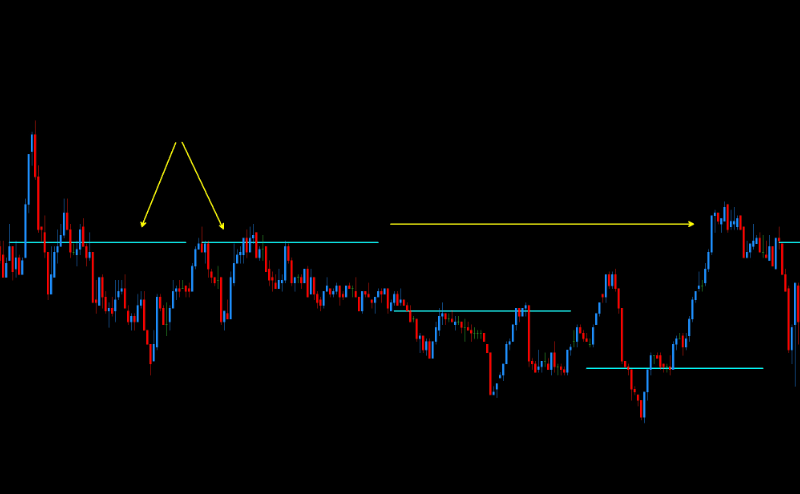

Approaching a "Double" Aqua

This is one of the most effective models for trading Aqua levels. It is applicable on the currency pairs where Aqua levels are available. In this model, we look for opportunities to position ourselves at two consecutive Aqua levels that appear at exactly the same price point. Often, such a double level is resolved after the second level's duration ends. A dedicated Expert Advisor is available for trading this model, which you can find on the automated tools page or ask the support team about this EA.

Examples of Price Reaction to Aqua Levels on Currency Pairs

Want more knowledge?

DodgerBlue

DodgerBlue levels represent an innovative analytical tool for forex traders. These are particularly significant price levels that have gained recognition especially among investors operating on the EURCAD currency pair.

Their unique feature lies in regular updates every 5 minutes, allowing for precise tracking of market dynamics.

Flow Zone Levels

Flow Zone (FZ) levels are liquidity flow-based indicators that serve as key support and resistance levels in the currency market. They are calculated using advanced algorithms that analyze high-value transactions and market dynamics. Due to their precision, FZ levels can be used by traders to identify critical moments in the market where price direction changes are likely to occur.