Lesson #14 - DodgerBlue

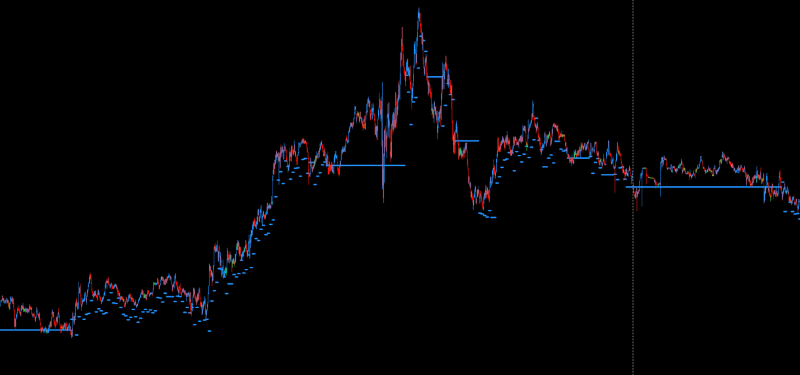

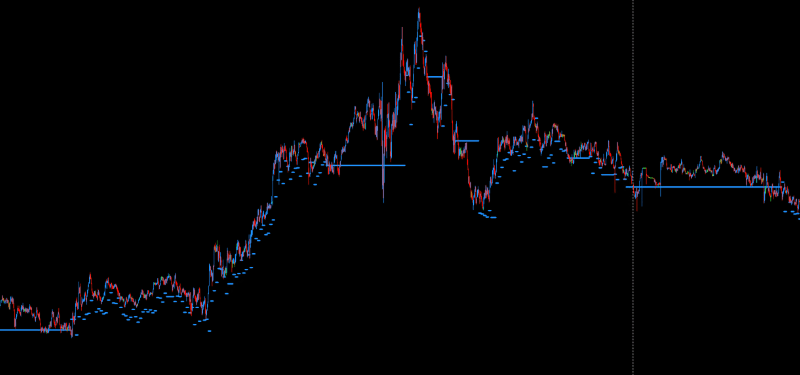

DodgerBlue levels represent an innovative analytical tool for forex traders. These are particularly significant price levels that have gained recognition especially among investors operating on the EURCAD currency pair. Their unique feature lies in regular updates every 5 minutes, allowing for precise tracking of market dynamics.

Characteristics and Significance of DodgerBlue

A particularly interesting aspect of DodgerBlue lev_els is their behavior during the Asian session. During this period, these levels often form a single, continuous line that typically persists until around 1:30 GMT. This continuity is crucial for traders, as it indicates a significant price level that can be utilized both during the existence of this line and after its conclusion.

Price reactions at DodgerBlue levels, although not always spectacular, are extremely important for experienced traders. Even small price movements at these points can yield profits of several pips, which is particularly attractive for scalpers. The high predictability of these movements has made DodgerBlue levels a valuable tool in many traders' arsenals, offering profit opportunities with a high probability of success.

Trading Strategies Based on DodgerBlue Levels

When using DodgerBlue levels, traders primarily focus on buy setups. This strategy is based on observing price behavior relative to these levels. If the price breaks through a DodgerBlue level, it's often expected to return to this level in later trading hours. This tendency creates additional opportunities for traders who can plan their transactions in advance.

It's worth emphasizing that DodgerBlue levels are particularly effective for the EURCAD currency pair. Traders specializing in this pair can find extremely valuable insights for making trading decisions in DodgerBlue levels.

Summary and Perspectives

DodgerBlue levels offer a unique view of the forex market, combining the precision of technical analysis with real-time market dynamics. Their effectiveness, especially in the context of the EURCAD pair and during the Asian session, makes them a valuable tool for traders seeking a competitive edge.

For those interested in scalping or short-term trading, DodgerBlue levels can be key to increasing the effectiveness of trading strategies. Regular monitoring of these levels, particularly at crucial moments of the Asian session, can lead to the identification of attractive trading opportunities.

Conclusion

DodgerBlue levels are an advanced analytical tool that, in the hands of an experienced trader, can significantly improve trading results. Their unique character and effectiveness make them an increasingly popular element of trading strategies in the forex market.

Advanced sets of DML levels for the EURCAD currency pair

EUDCAD Edu

A complete package dedicated to those who have completed the educational process.

20 GBP

10 days Plum levels

10 days MediumOrchid levels

10 days Coral levels

10 days Khaki levels

10 days Sienna levels

10 days DeepSkyBlue levels

10 days DodgerBlue levels

10 days SpringGreen levels

10 days DarkOrange levels

20 days Violet levels

20 days Aqua levels

20 days Olive levels

40 days Red levels

40 days Magenta levels

80 days Green levels

80 days SeaGreen levels

Free Tools for Downloading and Visualizing DML Levels

EURCAD Tra

A complete package of DML levels dedicated to active traders.

60 GBP

50 days Plum levels

50 days MediumOrchid levels

50 days Coral levels

50 days Khaki levels

50 days Sienna levels

50 days DeepSkyBlue levels

50 days DodgerBlue levels

50 days SpringGreen levels

50 days DarkOrange levels

60 days Violet levels

60 days Aqua levels

60 days Olive levels

120 days Red levels

120 days Magenta levels

200 days Green levels

200 days SeaGreen levels

Free Tools for Downloading and Visualizing DML Levels

EUCA Fund

Complete DML Levels Package Dedicated to Financial Institutions

200 GBP

100 days Plum levels

100 days MedOrchid levels

100 days Coral levels

100 days Khaki levels

100 days Sienna levels

100 days DeepSkyBlue levels

100 days DodgerBlue levels

100 days SpringGreen levels

100 days DarkOrange levels

100 days Violet levels

100 days Aqua levels

100 days Olive levels

200 days Red levels

200 days Magenta levels

400 days Green levels

400 days SeaGreen levels

Free Tools for Downloading and Visualizing DML Levels

Note: The content of the data packages offered on DeepMarketLevel.com may be greater than what is published on this page. Check the current available offer and always stay one step ahead of other market participants.

Introduce your idea

If you want to test DodgerBlue levels for EURCAD, we have prepared a unique offer for you.

For only 2 GBP per month, you will have access to DodgerBlue levels. If you purchase these levels in advance for 6 months, the price drops to 1 GBP per month of use. Is it worth it? Find out for yourself.

Want more knowledge?

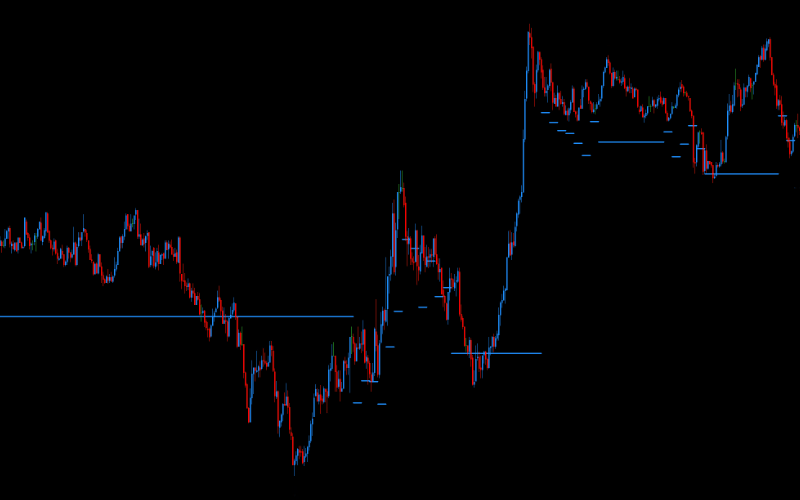

SeaGreen & Green

SeaGreen levels are monthly supports and resistances set at the beginning of each calendar month. The price rarely reaches these levels, but when it does, it usually either changes direction long-term or consolidates at that level. This makes it an ideal level for investors and traders who position their trades over a longer time frame.

Aqua

Aqua levels, similar to Violet levels, are retrieved every hour, although their characteristics are quite different. Violet levels, for reference, typically hold one level throughout most of the day, then shift to a new level in the evening after the Flow Zone (FZ). In contrast, Aqua levels usually appear near the current price level.